Introduction

Real Estate Investment Trusts (REITs) have become one of the most popular ways for investors to generate passive income without the hassle of owning and managing physical properties. These publicly traded companies allow investors to earn returns from real estate assets like commercial buildings, apartments, and retail spaces while benefiting from dividends and long-term appreciation. Investing in Real Estate Investment Trusts provides a unique opportunity to diversify portfolios, enjoy steady cash flow, and participate in the real estate market with minimal effort.

Unlike direct real estate investments, which require capital, property management skills, and market research, Real Estate Investment Trusts offer a hands-off investment option with liquidity and transparency. With the rising demand for real estate and the increasing popularity of REITs, now is the perfect time to explore this investment vehicle for financial growth in 2025.

In this guide, we will explore the top 10 reasons why investing in Real Estate Investment Trusts is a smart move for generating passive income in 2025 and how these investment vehicles can help investors build long-term wealth.

Stable and Reliable Passive Income

Real Estate Investment Trusts are required by law to distribute at least 90% of their taxable income as dividends, making them a consistent source of passive income for investors. Unlike traditional rental properties, where rental income depends on tenant occupancy and property management, REITs provide a stable cash flow to investors, making them an attractive option for retirees and income-focused individuals.

The dividend yields from REITs are often higher than traditional stocks, providing investors with a steady income stream. Since these trusts earn rental revenue from commercial and residential properties, their dividends are backed by real, tangible assets, reducing the risks associated with market volatility.

Additionally, many REITs increase dividend payouts over time, allowing investors to benefit from rising income while enjoying the advantages of a passive investment strategy. This makes Real Estate Investment Trusts a preferred choice for those looking to achieve financial independence through real estate investments.

Diversification Across Multiple Real Estate Sectors

Investing in Real Estate Investment Trusts allows investors to diversify across different real estate asset classes, including residential, commercial, industrial, healthcare, and retail properties. Instead of relying on a single real estate asset, investors can spread their risk across multiple sectors and geographies.

For example, a REIT specializing in shopping malls may perform well during economic upswings, while a healthcare REIT could remain resilient even during recessions due to the steady demand for medical facilities. This built-in diversification helps investors protect their portfolios from market downturns and economic fluctuations.

Additionally, REITs provide access to international real estate markets, allowing investors to tap into opportunities beyond their local markets. Global REITs enable investors to benefit from strong real estate markets in high-growth regions such as Asia, Europe, and North America.

Liquidity and Ease of Trading

Unlike physical real estate investments, which require months to buy or sell, Real Estate Investment Trusts are highly liquid and can be traded on major stock exchanges like any other stock. This means investors can buy or sell REIT shares instantly, making it easier to adjust their investment strategies based on market conditions.

The liquidity of REITs is a major advantage compared to direct real estate investments, where investors may face challenges in selling properties quickly, especially during economic downturns. With REITs, investors enjoy the benefits of real estate ownership without the complexities of property transactions.

Additionally, REITs provide access to real estate investments without requiring large capital commitments. Investors can start with a small amount and gradually increase their holdings over time, making REITs a flexible and scalable investment option.

Tax Advantages of Investing in REITs

One of the significant benefits of Real Estate Investment Trusts is their tax-efficient structure. Since REITs are required to distribute the majority of their income to shareholders, they are exempt from corporate income tax, allowing investors to benefit from higher dividend payouts.

Additionally, investors can take advantage of preferential tax treatments on REIT dividends, particularly through tax-advantaged accounts such as IRAs and 401(k) plans. By holding REITs in these accounts, investors can defer or eliminate taxes on their investment income, enhancing long-term wealth accumulation.

Furthermore, some REIT dividends qualify for the Qualified Business Income (QBI) deduction, allowing investors to deduct up to 20% of their REIT dividends from their taxable income. These tax benefits make Real Estate Investment Trusts an attractive choice for investors looking to maximize after-tax returns.

Hedge Against Inflation

Real estate has long been considered a hedge against inflation, and Real Estate Investment Trusts provide investors with an effective way to protect their wealth from rising prices. Since REITs generate revenue from rental income, landlords can adjust rental rates to keep up with inflation, ensuring that investors maintain their purchasing power over time.

Additionally, real estate values tend to appreciate during inflationary periods, providing investors with capital appreciation along with regular dividend income. This makes Real Estate Investment Trusts a valuable asset class for those looking to preserve wealth during periods of economic uncertainty.

With inflation concerns on the rise in 2025, REITs offer a safe and reliable way to safeguard investments while generating steady income, making them a compelling choice for both conservative and growth-oriented investors.

How REITs Compare to Traditional Real Estate Investments

| Feature | REITs | Traditional Real Estate |

|---|---|---|

| Liquidity | High | Low |

| Minimum Investment | Low | High |

| Diversification | High | Low |

| Management Effort | None | High |

| Passive Income | Yes | Yes |

| Tax Benefits | Yes | Limited |

Investors often face a choice between Real Estate Investment Trusts (REITs) and traditional real estate investments. While both provide opportunities for wealth generation, they differ in structure, management, and return potential.

REITs offer liquidity, allowing investors to buy and sell shares on public stock exchanges, whereas traditional real estate requires time-consuming transactions. Additionally, Real Estate Investment Trusts REITs require lower initial capital compared to purchasing physical properties, making them more accessible to a wider range of investors.

In contrast, traditional real estate offers direct control over property management and the potential for higher appreciation through renovations and improvements. However, it also comes with higher risks, such as market downturns, tenant vacancies, and maintenance costs.

The Role of Technology in Modern REITs

Technology is revolutionizing the way Real Estate Investment Trusts operate. From data-driven decision-making to blockchain-enabled transactions, modern REITs are leveraging technological advancements to enhance profitability and efficiency.

✔ AI-powered market analysis enables REITs to assess trends and optimize real estate acquisitions. ✔ Blockchain technology improves transaction security and enhances transparency in real estate deals. ✔ Smart property management systems help REITs reduce maintenance costs and improve tenant experiences.

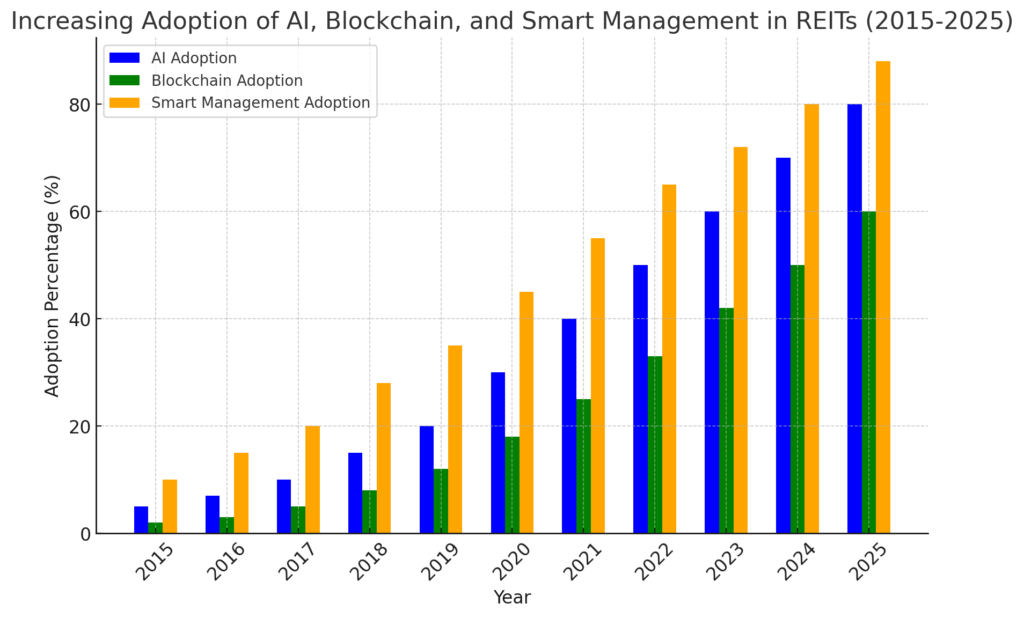

Bar Chart: Growth of Technology in REIT Management (2015-2025)

The bar chart illustrates the steady rise in the adoption of AI (Artificial Intelligence), Blockchain, and Smart Property Management in Real Estate Investment Trusts (REITs) over the past decade. In 2015, AI and Blockchain adoption were relatively low, with AI at just 5% and Blockchain at 2%, indicating that these technologies were in their early stages of implementation in real estate.

Smart property management had a slightly higher adoption rate of 10%, as property automation and IoT-based management solutions had already started making an impact in the industry. However, as digital transformation accelerated, the chart clearly shows a significant growth trajectory for all three technologies, particularly from 2020 onwards, as companies began integrating AI-driven analytics, secure blockchain transactions, and smart automation solutions into real estate management.

(A bar chart here will depict the increasing adoption of AI, blockchain, and smart management in REITs over the past decade.)

Between 2020 and 2025, the adoption rates of these technologies surged dramatically. AI implementation in REITs increased from 30% in 2020 to nearly 80% in 2025, reflecting the widespread use of AI for market analysis, predictive pricing, and tenant experience enhancements. Blockchain adoption followed a similar trend, growing from 12% in 2020 to 60% by 2025, primarily due to its role in secure transactions, smart contracts, and transparent record-keeping. Meanwhile, Smart Property Management adoption saw the highest growth, reaching nearly 88% by 2025, indicating that automated systems for energy efficiency, security monitoring, and remote property management have become industry standards.

This trend suggests that technology-driven REITs will dominate the market in the coming years, as investors and property managers increasingly rely on AI-driven insights, blockchain security, and smart automation to optimize operations and maximize profitability. The growing integration of these technologies reflects an ongoing shift towards data-driven decision-making and sustainability-focused management in real estate investments. Investors looking to capitalize on REITs should consider those that are actively incorporating AI and blockchain innovations, as these advancements will likely drive long-term efficiency, security, and profitability in the REIT sector.

Types of Real Estate Investment Trusts (REITs) and Their Investment Potential

Investors can choose from several types of REITs, each offering unique benefits and risks:

✔ Equity REITs – Own and manage income-generating properties such as apartments, shopping malls, and office spaces. ✔ Mortgage REITs (mREITs) – Provide loans to real estate owners and earn interest income. ✔ Hybrid REITs – Combine features of both equity and mortgage REITs. ✔ Retail, Residential, and Healthcare REITs – Specialize in specific property sectors for niche investment opportunities.

Real Estate Investment Trusts (REITs) come in various types, each catering to different segments of the real estate market. Equity REITs are the most common, owning and managing income-generating properties like office buildings, shopping malls, residential apartments, and industrial warehouses. These REITs generate revenue primarily through rental income, making them a popular choice for investors looking for steady dividend payments and long-term capital appreciation. Mortgage REITs (mREITs), on the other hand, invest in real estate loans and mortgage-backed securities rather than physical properties. They earn money through interest on these loans, making them more sensitive to interest rate changes and market fluctuations.

Hybrid REITs combine aspects of both equity and mortgage REITs, offering diversified exposure to the real estate sector by holding a mix of physical properties and mortgage assets.Specialized REITs focus on niche markets like healthcare, data centers, hotels, and infrastructure, providing investors with opportunities to capitalize on high-growth industries. Healthcare REITs invest in medical office buildings, senior living facilities, and hospitals, benefiting from the increasing demand for healthcare services.

Data center REITs have gained traction due to the digital transformation and rising demand for cloud computing and data storage. Retail REITs, while once dominant, have faced challenges due to e-commerce disruption but continue to thrive in prime locations. Investors should assess economic trends, market demand, and industry growth potential when selecting REITs, as different sectors perform uniquely based on macroeconomic conditions and evolving consumer behavior.

How to Choose the Best Real Estate Investment Trusts (REITs) for Your Portfolio

Selecting the best Real Estate Investment Trusts (REITs) requires thorough research and an understanding of key financial and market indicators. One of the most important factors to consider is the dividend yield, as REITs are known for their income-generating potential. A higher dividend yield may seem attractive, but investors should also evaluate the sustainability of dividend payments by analyzing the funds from operations (FFO) and payout ratios. A REIT with consistent dividend growth over time is generally more reliable than one offering unsustainable high yields.

Additionally, reviewing the property types and market sectors within a REIT is crucial. For instance, residential and healthcare REITs tend to be more resilient during economic downturns, while retail and office REITs may be more sensitive to market fluctuations.Another important factor is management quality and historical performance. A well-managed REIT with a strong track record of growth, stable occupancy rates, and prudent financial decisions is more likely to generate steady returns.

Investors should examine debt levels, leverage ratios, and interest coverage to ensure the REIT is not overly burdened with liabilities. Diversification within a REIT’s portfolio also plays a key role in risk management—those with properties spread across different regions and industries offer better protection against local market downturns. Additionally, macro trends like interest rates, inflation, and real estate demand should be considered when picking the best REITs for a portfolio. By combining fundamental analysis with sector-specific insights, investors can make well-informed decisions and select REITs that align with their financial goals.

REITs and Economic Cycles: How They Perform During Market Fluctuations

REITs, like all investments, are affected by economic cycles. Understanding how they perform in different conditions helps investors mitigate risks.

✔ During Economic Booms – REITs flourish as demand for office spaces, retail centers, and industrial properties increases. ✔ During Recessions – Some REIT sectors, such as healthcare and residential, remain stable due to constant demand, while others, like commercial and hospitality, may suffer losses. ✔ Interest Rate Impact – Rising interest rates may reduce REIT profitability, whereas falling rates enhance borrowing opportunities.

Top Performing REITs in 2025: Market Leaders to Watch

Several Real Estate Investment Trusts (REITs) are leading the market in 2025 due to strong financial performance and innovative strategies. These include:✔ Prologis (PLD) – A dominant industrial REIT benefiting from e-commerce growth. ✔ Welltower (WELL) – A leading healthcare REIT capitalizing on the aging population trend. ✔ Simon Property Group (SPG) – A retail REIT known for premium shopping centers.

As the real estate sector evolves in 2025, several Real Estate Investment Trusts (REITs) have emerged as market leaders due to their strong financial performance, strategic property acquisitions, and adaptability to economic shifts. Prologis (PLD) continues to dominate the industrial REIT sector, benefiting from the surge in e-commerce and the increasing demand for modern warehouse spaces. With global supply chains expanding and companies focusing on logistics and distribution centers, Prologis has positioned itself as a key player in this high-growth market. Similarly, Welltower (WELL), a leading healthcare REIT, has capitalized on the aging population trend by investing in senior housing, medical office buildings, and assisted living facilities

Final Verdict: Are REITs the Best Passive Income Investment?

Investing in Real Estate Investment Trusts (REITs) offers a unique and powerful way to earn passive income while benefiting from the stability and growth of the real estate sector. With high dividend yields, portfolio diversification, tax advantages, and liquidity, REITs stand out as a preferred choice for both beginner and experienced investors. Their ability to provide inflation protection and consistent returns, even during economic fluctuations, makes them an attractive alternative to traditional real estate investments.

However, like all investments, Real Estate Investment Trusts (REITs) come with risks. Market volatility, economic downturns, and fluctuating interest rates can impact performance. Smart investors should diversify across different types of REITs, research financials, and monitor market trends to maximize their returns. The integration of AI, blockchain, and smart property management also indicates a bright future for technology-driven REITs, offering investors more security and efficiency.

For those seeking passive income with minimal effort, REITs remain one of the best investment vehicles in 2025. Whether you’re looking to grow your wealth, generate steady dividends, or hedge against inflation, Real Estate Investment Trusts provide a solid and scalable investment option.

What’s Your Take on Investing in REITs?

💬 Are you considering Real Estate Investment Trusts for your investment portfolio in 2025? Share your thoughts in the comments below!

🔹 Related Articles:

10 Shocking Secrets About Flipping Houses vs Renting in 2025 – Avoid These Costly Mistakes!

Powerful ways to IoT in Real Estate is Revolutionizing: Unlocking Smart Property Management

Unstoppable AI-Powered Predictive Analytics: Revolutionizing Real Estate for Smarter Investments