Investing in real estate crowdfunding and REITs (Real Estate Investment Trusts) has revolutionized the way both beginner and experienced investors can enter the real estate market. Traditionally, real estate investments required significant capital and deep market knowledge, but the rise of these modern platforms has democratized real estate investing. Whether you’re aiming for steady dividends through REITs or looking for direct ownership in crowdfunding projects, these investment avenues offer excellent ways to earn passive income.

In this post, we’ll explore the mechanisms behind investing in real estate crowdfunding, the benefits of REITs, the risks involved, and how you can optimize your portfolio for long-term success. Along the way, we’ll also include some internal and external links to help deepen your understanding of these tools and strategies.

Introduction to Investing in real estate crowdfunding and REITs

Investing in real estate crowdfunding and REITs are powerful tools for building passive income. Both allow investors to participate in large-scale real estate projects without the burden of property management or the need for substantial upfront capital.

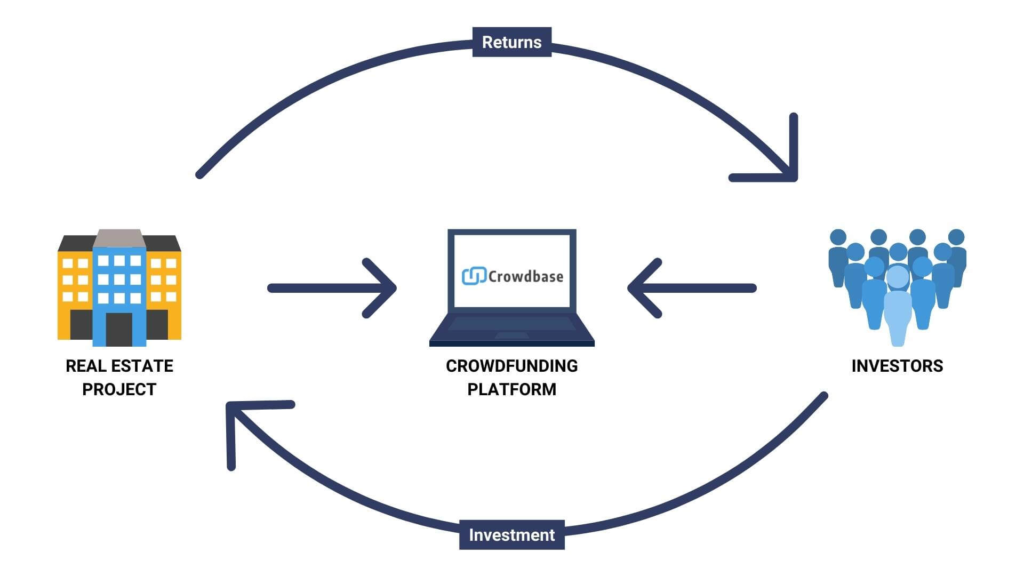

Real estate crowdfunding involves pooling funds from multiple investors to finance property purchases, developments, or renovations. These platforms allow individuals to invest in a portion of a property rather than buying the whole thing, making it a low-barrier way to get into real estate.

REITs, on the other hand, are companies that own, operate, or finance income-generating real estate. They are publicly traded on major exchanges, and anyone can buy shares, providing access to real estate markets without the need to own physical property.

How Does Investing in real estate crowdfunding Work?

Crowdfunding platforms have transformed how people invest in real estate by providing access to commercial and residential projects that were once reserved for institutional investors or high-net-worth individuals. Investing in real estate crowdfunding allows you to put your money into various real estate deals—such as multifamily buildings, retail spaces, and industrial properties—through online platforms like Fundrise, RealtyMogul, or Crowdstreet.

- Types of Crowdfunding Models:

- Equity-based crowdfunding: Investors own shares in the property and share in the profits when it is sold or rented out.

- Debt-based crowdfunding: Investors lend money to developers and earn interest on their investment. This type of crowdfunding is generally less risky, but the returns are often lower compared to equity-based models.

- Minimum Investment Requirements:

- Depending on the platform, you can start with as little as $500. This lower threshold makes it easier for people to participate in real estate crowdfunding investments than traditional real estate purchases.

- Potential Returns:

- Returns from crowdfunding depend on the success of the real estate project, and they typically range from 8% to 12%. While this can be attractive, keep in mind that these investments can be less liquid than stocks and bonds.

- Platform Fees:

- Crowdfunding platforms charge management fees, usually around 1% to 2%, which can impact your overall returns.

How Do REITs Work?

REITs (Real Estate Investment Trusts) are companies that own or finance income-producing real estate across various sectors. By law, REITs must return 90% of their taxable income to shareholders in the form of dividends, making them an excellent choice for investors seeking passive income. Unlike crowdfunding, which focuses on direct ownership in specific properties, investing in REITs allows you to diversify your portfolio across a range of real estate assets by simply purchasing shares.

- Types of REITs:

- Equity REITs: Own and operate income-producing properties like apartment complexes, office buildings, and shopping centers. They generate revenue primarily from leasing space and collecting rent.

- Mortgage REITs: Provide financing for income-producing properties by purchasing or originating mortgages and mortgage-backed securities. They generate revenue through interest earned on these loans.

- Hybrid REITs: Combine both equity and mortgage investments.

- Liquidity and Accessibility:

- REITs are publicly traded on stock exchanges, offering investors liquidity similar to stocks and bonds. You can buy or sell shares at any time, making REITs one of the most flexible ways to invest in real estate.

- Dividend Income:

- One of the biggest advantages of REITs is the regular dividend payments. Because REITs are required to pay out 90% of their income to shareholders, they typically provide higher dividends than most stocks, with average yields ranging between 4% and 8%.

- Tax Considerations:

- Dividends from REITs are taxed as ordinary income, which could be higher than the capital gains tax rates that apply to other investments. However, they offer the potential for regular, reliable income. Check Investopedia for the details tax implications for the crowdfunding and RIETs

Benefits of Real Estate Crowdfunding

- Low Barrier to Entry:

- Unlike direct real estate investments, investing in real estate crowdfunding does not require large amounts of capital. With investments starting as low as $500, it’s possible for almost anyone to get started.

- Portfolio Diversification:

- Crowdfunding platforms allow you to diversify your portfolio by investing in different types of real estate projects—residential, commercial, industrial, or even mixed-use developments.

- Hands-off Investment:

- By investing through a crowdfunding platform, you don’t have to deal with the headaches of property management, tenant issues, or maintenance. The platform handles everything, making it a passive income strategy.

- Potential for High Returns:

- Some real estate crowdfunding investments offer returns of up to 12%, which can be attractive compared to more traditional investment options. However, this comes with its own set of risks, as discussed below.

Benefits of REITs

- Steady Dividends:

- REITs are known for providing regular dividend payments, making them an ideal option for investors looking for consistent income. The average dividend yield for REITs typically outpaces other income-producing assets, like bonds or dividend-paying stocks.

- Liquidity:

- Unlike real estate crowdfunding, which can tie up your money for years, REITs offer liquidity. You can easily buy and sell shares on major stock exchanges.

- Diversification:

- REITs offer exposure to various real estate sectors, such as residential, commercial, industrial, and even specialized properties like healthcare facilities or data centers.

- Low Minimum Investment:

- Since REITs are publicly traded, you can start with the price of a single share, which could be as low as $10 to $50 depending on the REIT.

Risks of Real Estate Crowdfunding

- Illiquidity:

- Most real estate crowdfunding investments require a long-term commitment, often locking your money up for several years. Unlike REITs, you can’t simply sell your shares if you need cash.

- Platform Risk:

- While there are many reputable crowdfunding platforms, the industry is still relatively new. There’s always a risk that a platform could go under, leaving your investment in limbo.

- Market Risk:

- The success of real estate crowdfunding projects depends on market conditions. A downturn in the real estate market can reduce the value of the property, leading to lower returns or even losses.

Risks of REITs

- Market Volatility:

- Since REITs are traded like stocks, they are subject to market fluctuations. While the underlying real estate may be stable, share prices can experience volatility, especially during economic downturns.

- Interest Rate Sensitivity:

- REITs are sensitive to interest rate changes. When interest rates rise, REIT share prices tend to drop, as investors shift their focus to higher-yielding bonds.

- Tax Implications:

- Dividends from REITs are taxed as ordinary income, which can result in a higher tax rate compared to the capital gains tax applied to stock dividends.

How to Choose Between Crowdfunding and REITs

Choosing between real estate crowdfunding and REITs depends on your financial goals, risk tolerance, and investment timeline. Here are some factors to consider:

- Liquidity Needs:

- If you need flexibility and the ability to quickly sell your investments, REITs are the better option due to their liquidity. Crowdfunding, on the other hand, may lock up your funds for several years.

- Desired Returns:

- If you’re willing to take on more risk for potentially higher returns, investing in real estate crowdfunding might be appealing. However, if you’re looking for steady, predictable income, REITs are likely a better fit.

- Involvement in the Process:

- Crowdfunding offers more direct involvement in specific real estate projects. You can choose the types of properties and markets that appeal to you. REITs, on the other hand, provide a more hands-off approach, offering broader exposure to real estate markets without the need to pick individual projects.

Case Study: Real Estate Crowdfunding Success Story

Consider an investor who invested $10,000 in a crowdfunding project for a multi-family apartment building in Austin, Texas. Over the next five years, the property appreciated by 20%, and the investor received quarterly dividend payments from rental income. At the end of the investment period, the investor sold their equity stake for $12,000, earning a total return of $6,000 over five years.

Related Topics:

https://homelandlisting.com/commercial-real-estate-investment

https://homelandlisting.com/commercial-real-estate-investment/