Introduction

Real Estate Syndication has become one of the most accessible and profitable ways for investors to participate in large-scale property investments without requiring substantial upfront capital. By pooling resources with other investors, individuals can collectively acquire high-value properties such as apartment complexes, commercial buildings, and industrial facilities. Real Estate Syndication allows passive investors to enjoy steady cash flow, tax benefits, and property appreciation while relying on experienced syndicators to manage operations efficiently.

Unlike traditional real estate investing, which often requires hands-on property management and significant capital investment, Real Estate Syndication provides a hands-off approach where investors contribute funds while experienced professionals handle property acquisition, management, and eventual sale. Whether you are an accredited or non-accredited investor, this investment method opens the doors to wealth-building opportunities that would typically be out of reach for individual investors.

This guide will explore how Real Estate Syndication works, the benefits, risks, types of syndications, and strategies to maximize returns. By the end of this article, you will have a comprehensive understanding of how to invest in large properties without breaking the bank.

What is Real Estate Syndication?

Real Estate Syndication is a group investment strategy where multiple investors pool their money to purchase large real estate assets that would be difficult to acquire individually. This method allows investors to diversify their portfolios, access larger deals, and share both risks and rewards. A syndication deal typically consists of two key parties: Syndicators (Sponsors) and Passive Investors.

- Syndicators (Sponsors): These are experienced real estate professionals responsible for identifying deals, securing financing, managing the property, and executing the business plan.

- Passive Investors: Individuals who contribute capital in exchange for ownership shares and passive income from the property without being involved in daily operations.

The legal structure of most syndications is set up as a Limited Partnership (LP) or Limited Liability Company (LLC), where the sponsor serves as the general partner (GP) and investors act as limited partners (LPs). This structure helps to define the roles, responsibilities, and profit-sharing mechanisms between the two parties.

Table: Key Differences Between Syndicators and Passive Investors

| Role | Responsibilities | Risk Level | Reward Potential |

|---|---|---|---|

| Syndicator | Finds property, secures financing, manages operations | High | Higher Returns |

| Passive Investor | Provides capital, receives passive income | Lower | Steady Income |

Real Estate Syndication offers an alternative to REITs and direct real estate ownership, allowing investors to participate in real estate without managing tenants or maintenance. Furthermore, investors can mitigate risk by choosing well-established syndicators with a track record of successful deals.

How Real Estate Syndication Works

The process of Real Estate Syndication follows a structured approach to ensure investor protection and profitability:

✔ Deal Sourcing – The sponsor identifies a lucrative real estate opportunity, such as a multifamily apartment complex, retail center, or industrial facility. This involves extensive market research, feasibility studies, and risk assessments to ensure a profitable investment. ✔ Investor Pooling – Accredited and non-accredited investors pool their capital, typically structured as LLCs or Limited Partnerships (LPs). Investors review the Private Placement Memorandum (PPM), which outlines the deal structure, expected returns, risks, and exit strategies.

✔ Acquisition and Management – Once the property is acquired, the sponsor manages it while passive investors collect rental income. Sponsors implement value-add strategies such as renovations, tenant lease optimizations, and expense reductions to increase profitability. ✔ Exit Strategy – The property is held for a period (typically 5-10 years) and then sold for profit, with proceeds distributed to investors. Exit strategies may include refinancing, selling to institutional buyers, or a 1031 exchange to defer capital gains taxes.

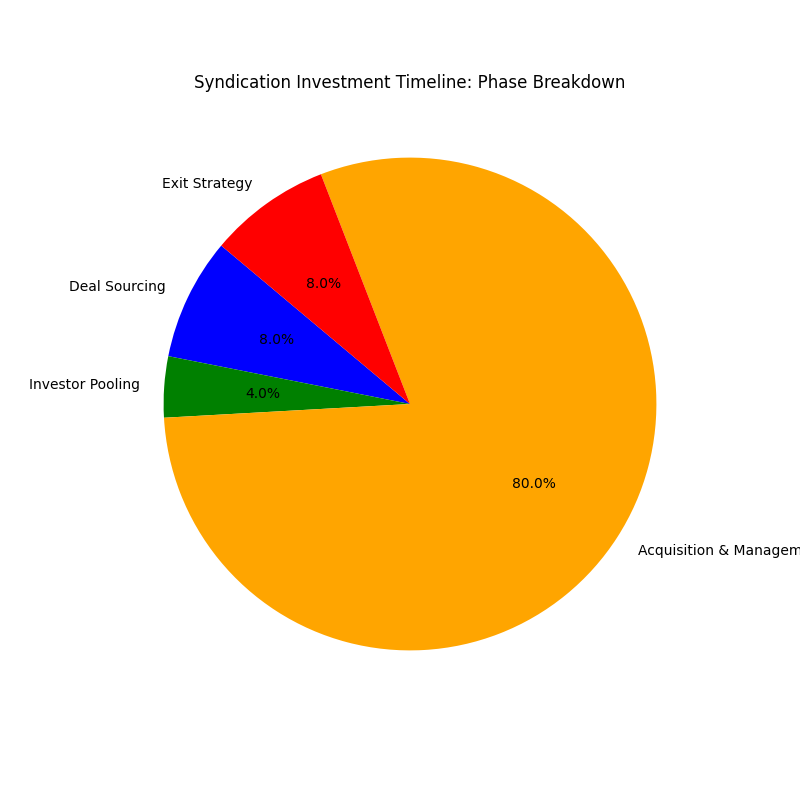

Graph: Real Estate Syndication Investment Timeline

(A bar chart will be placed here showing the different phases of Real Estate Syndication from Deal Sourcing to Exit Strategy.)

The Real Estate Syndication process follows a structured timeline with four key phases: Deal Sourcing, Investor Pooling, Acquisition & Management, and Exit Strategy. The Deal Sourcing phase typically lasts around 6 months, during which the sponsor conducts market research, identifies properties, negotiates deals, and structures the investment strategy. Next, the Investor Pooling phase, lasting about 3 months, focuses on raising capital from accredited and non-accredited investors, securing financing, and finalizing legal agreements. This phase ensures the necessary funds are in place before the acquisition.

The longest phase is Acquisition & Management, which spans 5 to 7 years (approximately 60 months). During this stage, rental income is generated, property improvements are made, and asset appreciation strategies are executed. This phase involves tenant management, operational optimizations, and long-term value creation. Finally, the Exit Strategy phase, lasting around 6 months, includes either selling the property for profit, refinancing, or initiating a 1031 exchange to defer capital gains taxes.

Benefits of Real Estate Syndication

Access to Large-Scale Investments

Investors can own a share of high-value commercial properties that are usually reserved for institutional investors. This allows for better returns, stable income, and capital appreciation. By pooling resources, individual investors gain access to deals they would not be able to fund on their own.

Another advantage of Real Estate Syndication is the ability to leverage economies of scale. When investing in large properties, operational costs per unit tend to be lower compared to individual property investments. This means maintenance, property management, and upgrades are distributed across multiple tenants and investors, reducing financial burdens and improving efficiency. Additionally, larger properties often attract more stable, long-term tenants such as corporations, government offices, and well-established businesses, which ensures steady occupancy rates and predictable rental income.

Furthermore, real estate syndications provide investors with an opportunity to access premium locations that might otherwise be out of reach. Investing in prime urban areas, high-growth suburban markets, or booming commercial hubs can lead to significant property appreciation and rental yield increases over time. These strategic investments enable small investors to benefit from real estate opportunities that are typically dominated by institutional players.

Passive Income and Hands-Off Investing

Additionally, syndications allow investors to focus on their primary careers, businesses, or other ventures while still enjoying the benefits of real estate ownership. Unlike managing rental properties, which requires handling tenant complaints, repairs, and vacancies, passive investors in a syndication deal simply collect returns while the sponsor handles daily operations. This freedom enables individuals to build a diversified income stream without being actively involved in property management.

Another critical advantage is the ability to scale real estate investments efficiently. Investors can participate in multiple syndications across different property types, locations, and asset classes, thereby spreading risk and enhancing financial security. With minimal effort, passive investors can create a steady income stream from multiple properties, ensuring financial stability and long-term wealth accumulation.

With professional property management, investors receive monthly or quarterly distributions without dealing with tenant issues, maintenance, or financial complexities. This provides true passive income without the responsibilities associated with direct property ownership.

Tax Advantages

One of the biggest tax advantages of Real Estate Syndication is the ability to use depreciation to offset rental income. Through strategies like bonus depreciation and cost segregation, investors can claim deductions on property components such as electrical systems, plumbing, and flooring, which reduces their taxable income significantly. This means that even though investors may receive cash flow distributions, their taxable income can be greatly reduced or even eliminated due to these depreciation write-offs.

Furthermore, Real Estate Syndication offers 1031 Exchange opportunities, allowing investors to defer capital gains taxes when reinvesting profits into another property. By continuously rolling over investments through 1031 Exchanges, investors can build long-term wealth while legally avoiding large tax liabilities. This tax-deferral strategy ensures that investors retain more of their earnings, compounding their returns over time and maximizing overall wealth creation.

Table: Comparing Real Estate Syndication to Direct Ownership and REITs

| Feature | Real Estate Syndication | REITs | Direct Ownership |

| Liquidity | Low | High | Low |

| Passive Income | Yes | Yes | No (Active Management) |

| Tax Benefits | High | Moderate | High |

| Control | Limited | None | Full |

| Minimum Investment | Moderate | Low | High |

Real Estate Syndication, REITs, and Direct Ownership each offer distinct advantages and challenges for investors. Syndication provides a balance between active and passive investing, allowing investors to own a portion of large real estate assets without the responsibility of property management. This model delivers strong tax benefits and higher potential returns, but it comes with longer investment horizons and lower liquidity compared to REITs. On the other hand, REITs offer high liquidity and diversification since they are publicly traded, making them ideal for investors looking for flexibility. However, they often provide lower tax benefits and reduced control over asset selection, which may not be appealing to investors seeking direct influence over their portfolio.

Direct Ownership, while offering full control and customization, requires significant capital, active management, and higher risk exposure due to market fluctuations and operational responsibilities. Investors must handle tenant management, maintenance, and legal matters, which can be time-consuming. Although direct ownership provides long-term appreciation and cash flow, it lacks the scalability and risk diversification that syndications and REITs offer.

Future of Real Estate Syndication in 2025 and Beyond

✔ Rise of Crowdfunding Platforms – More accessible Real Estate Syndication opportunities for retail investors, democratizing access to commercial real estate. ✔ Technological Advancements – Blockchain and AI improving transaction transparency, streamlining due diligence, and reducing fraud risks. ✔ Shift to Sustainable Properties – Increased focus on green real estate and ESG investments, making environmentally-friendly properties more attractive to investors.

The future of Real Estate Syndication is expected to be shaped by technological innovations and market trends that make it easier for investors to participate in lucrative real estate deals. The growing adoption of blockchain-based smart contracts is enhancing transparency, security, and efficiency in syndication transactions, reducing paperwork and ensuring seamless deal execution. Additionally, AI-powered predictive analytics are helping sponsors identify high-growth real estate markets, optimizing property management and improving investment decision-making.

Moreover, as sustainability becomes a focal point in real estate, investors are increasingly turning to eco-friendly developments and energy-efficient properties. Many syndicators are now integrating ESG (Environmental, Social, and Governance) criteria into their investment strategies, ensuring that properties align with global sustainability goals. This trend not only increases the long-term value of assets but also attracts institutional investors and environmentally-conscious stakeholders who prefer sustainable real estate investments.

✔ Rise of Crowdfunding Platforms – More accessible Real Estate Syndication opportunities for retail investors, democratizing access to commercial real estate. ✔ Technological Advancements – Blockchain and AI improving transaction transparency, streamlining due diligence, and reducing fraud risks. ✔ Shift to Sustainable Properties – Increased focus on green real estate and ESG investments, making environmentally-friendly properties more attractive to investors.

Maximizing Returns with Real Estate Syndication

Investors looking to enhance profitability in Real Estate Syndication should focus on strategic investment selection, strong sponsor partnerships, and effective exit strategies. By partnering with experienced syndicators who have a track record of successful real estate deals, investors can minimize risks and optimize returns. Additionally, choosing syndications with value-add properties, where renovations or operational improvements can increase cash flow, allows investors to capitalize on higher rental income and property appreciation over time.

Another key to maximizing returns in Real Estate Syndication is understanding the importance of reinvesting profits. Investors who use cash flow distributions from syndications to reinvest in multiple syndication deals can create a compound growth effect, increasing their wealth over time. By diversifying across different asset classes, geographic regions, and syndication structures, investors can further mitigate risk while benefiting from the scalability of syndication investments.

The Role of Market Cycles in Real Estate Syndication

Understanding market cycles is crucial for investors in Real Estate Syndication to determine the best timing for entry and exit. The real estate market moves through phases of expansion, peak, contraction, and recovery, impacting property valuations and rental demand. During an expansion phase, property values rise, rental demand increases, and syndications tend to perform well. This is an optimal period for investors to enter syndication deals to capitalize on market growth and increasing returns.

Conversely, during a contraction phase, property values may decline, and rental income could be affected. In such times, experienced sponsors implement risk mitigation strategies, such as conservative financing structures and diversified property portfolios, to safeguard investor capital. Investors who stay informed about market trends and align their investments with cyclical real estate trends can better position themselves for long-term success in Real Estate Syndication.

Real Estate Syndication is an excellent investment strategy for those looking to own large-scale properties without active management. It offers steady income, high returns, and diversification, making it ideal for both seasoned and first-time investors. However, investors should conduct thorough due diligence and partner with trustworthy sponsors to maximize success. Investors who are seeking long-term wealth creation through passive investing should seriously consider syndications as part of their overall strategy.

One of the key factors to consider when deciding whether Real Estate Syndication is the right fit is risk tolerance and investment horizon. Since syndications typically require a commitment of 5-10 years, investors must be comfortable with their capital being tied up for an extended period. Unlike publicly traded stocks or REITs, syndications are less liquid, meaning that exiting an investment early may not be an option without significant penalties or financial losses.

Another consideration is the importance of choosing the right syndicator. The success of a syndication largely depends on the experience and track record of the sponsor. Investors should carefully evaluate the sponsor’s past performance, investment strategy, transparency, and communication practices before committing funds. Those who take the time to research and select reputable syndicators can enjoy strong financial gains, passive income, and long-term real estate appreciation while minimizing risks.

Real Estate Syndication is an excellent investment strategy for those looking to own large-scale properties without active management. It offers steady income, high returns, and diversification, making it ideal for both seasoned and first-time investors. However, investors should conduct thorough due diligence and partner with trustworthy sponsors to maximize success. Investors who are seeking long-term wealth creation through passive investing should seriously consider syndications as part of their overall strategy.

Final Verdict: Is Real Estate Syndication Right for You?

Real Estate Syndication is an excellent investment strategy for those looking to own large-scale properties without active management. It offers steady income, high returns, and diversification, making it ideal for both seasoned and first-time investors. However, investors should conduct thorough due diligence and partner with trustworthy sponsors to maximize success. Investors who are seeking long-term wealth creation through passive investing should seriously consider syndications as part of their overall strategy.

Another consideration is the importance of choosing the right syndicator. The success of a syndication largely depends on the experience and track record of the sponsor. Investors should carefully evaluate the sponsor’s past performance, investment strategy, transparency, and communication practices before committing funds. Those who take the time to research and select reputable syndicators can enjoy strong financial gains, passive income, and long-term real estate appreciation while minimizing risks.

Real Estate Syndication is an excellent investment strategy for those looking to own large-scale properties without active management. It offers steady income, high returns, and diversification, making it ideal for both seasoned and first-time investors. However, investors should conduct thorough due diligence and partner with trustworthy sponsors to maximize success. Investors who are seeking long-term wealth creation through passive investing should seriously consider syndications as part of their overall strategy.

What’s Your Take on Real Estate Syndication?

💬 Are you considering Real Estate Syndication as part of your investment strategy in 2025? Share your thoughts in the comments!

🔹 Related Articles:

Powerful ways to IoT in Real Estate is Revolutionizing: Unlocking Smart Property Management

Unstoppable AI-Powered Predictive Analytics: Revolutionizing Real Estate for Smarter Investments

Unlocking Blockchain Revolutionary Success in Real Estate Transactions